-

GIPS® Standards Handbook for Asset Owners

Download PDFExplanation of the Provisions in Sections 21-26

November 2020

GIPS® is a registered trademark owned by CFA Institute.

© 2020 CFA Institute. All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the copyright holder.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is distributed with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional should be sought.

ISBN 978-1-953337-00-9

Introduction

The Global Investment Performance Standards (GIPS®) for Asset Owners are divided into six sections, which are as follows:

- 21. Fundamentals of Compliance

- 22. Input Data and Calculation Methodology

- 23. Total Fund and Composite Maintenance

- 24. Total Fund and Composite Time-Weighted Return Report

- 25. Additional Composite Money-Weighted Return Report

- 26. GIPS Advertising Guidelines

The Explanation of the Provisions in Sections 21-26 provides interpretation of each provision contained in Sections 21-26. Asset Owners that choose to comply with the GIPS standards must comply with all applicable requirements of the GIPS standards, including any Guidance Statements, interpretations, and Questions and Answers (Q&As) published by CFA Institute and the GIPS standards governing bodies.

Section 21: Fundamentals of Compliance.

The Fundamentals of Compliance section includes several core principles that create the foundation for the GIPS standards, including properly defining the asset owner, providing GIPS Asset Owner Reports to those who have direct oversight responsibility for total fund assets and total asset owner assets, adhering to applicable laws and regulations, and ensuring that information presented is not false or misleading.Section 22: Input Data and Calculation Methodology.

Consistency of input data used to calculate performance is critical to effective compliance with the GIPS standards and establishes the foundation for full and fair investment performance presentations. Achieving transparency among asset owner’s performance presentations requires uniformity in methods used to calculate returns. The GIPS standards mandate the use of certain calculation methodologies to facilitate a clear understanding of the information. It is important that the data being presented to the oversight body is consistent and transparent to aid in the evaluation of performance information and foster strong investment decision-making.Section 23: Total Fund and Composite Maintenance.

A total fund is a pool of assets managed by an asset owner according to a specific investment mandate, which is typically composed of multiple asset classes. The total fund is typically composed of underlying portfolios, each representing one of the strategies used to achieve the asset owner’s investment mandate. The asset owner is required to create a total fund and present total fund information to the oversight body.A composite is an aggregation of one or more portfolios managed according to a similar investment mandate, objective, or strategy. The composite return is the asset-weighted average of the performance of all portfolios in the composite. Asset owners are not required to present composites in compliance with the GIPS standards but may choose to do so. If an asset owner chooses to create an additional composite and present it in a GIPS Asset Owner Report, it must present the GIPS Asset Owner Report to the oversight body.

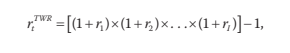

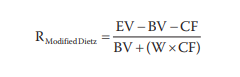

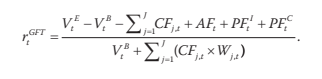

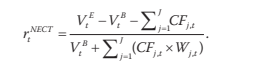

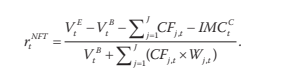

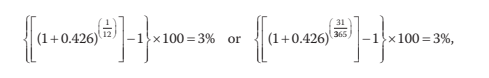

Section 24: Total Fund and Composite Time-Weighted Return Report.

Section 24 includes the requirements and recommendations for preparing a GIPS Asset Owner Report that includes time-weighted returns. Asset owners that prepare a GIPS Asset Owner Report that includes time-weighted returns must include the required numerical information and disclosures specified in Section 24, if applicable to the specific total fund or composite.Section 25: Additional Composite Money-Weighted Return Report.

Section 25 includes the requirements and recommendations that apply to asset owners that calculate and report additional composite performance in a GIPS Asset Owner Report using money-weighted returns. An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.Section 26: GIPS Advertising Guidelines.

The Explanation of the Provisions in Section 26 provides interpretation of each provision that is included in Section 26 – GIPS Advertising Guidelines. Asset owners may wish to prepare materials that are widely distributed, such as annual reports provided to beneficiaries and posted on the asset owner’s website. The asset owner may wish to include the fact that the asset owner claims compliance with the GIPS standards but does not wish to include a lengthy GIPS Asset Owner Report for the total fund. The asset owner may instead choose to prepare these materials following the GIPS Advertising Guidelines. To claim compliance with the GIPS standards in an advertisement, asset owners must adhere to the GIPS Advertising Guidelines or include a GIPS Asset Owner Report.Each provision is included in a grey text box. Within the provisions are words appearing in small capital letters. This indicates defined terms that can be found in the GIPS Standards Glossary. Below each provision is a discussion that provides interpretive guidance to help readers understand the provision.

21. Fundamentals of Compliance

21.A. Fundamentals of Compliance - Requirements

Provision 21.A.1

The GIPS standards MUST be applied on an ASSET OWNER-wide basis. Compliance MUST be met on an ASSET OWNER-wide basis and cannot be met on a total FUND, COMPOSITE, POOLED FUND, or PORTFOLIO basis.

Discussion

The GIPS standards provide an ethical framework for calculating and presenting an asset owner’s investment performance history. The definition of the asset owner is the foundation for asset owner-wide compliance and creates defined boundaries for determining total asset owner assets. Only asset owners that have discretion over total fund assets, either by managing assets directly or by having the discretion to hire and fire external managers, may claim compliance with the GIPS standards.

To claim compliance, an asset owner must comply with all the applicable requirements of the GIPS standards. Compliance cannot be met on a total fund, composite, pooled fund, or portfolio basis and can be met only on an asset owner-wide basis. For example, if an asset owner definition includes both equity and fixed-income assets, the asset owner cannot present only its equity assets as being in compliance with the GIPS standards. If an asset owner definition includes two total funds, the asset owner cannot present only one total fund as being in compliance with the GIPS standards.

Some asset owners, such as pension funds, manage the assets of other related asset owners to gain efficiencies and cost savings. For example, a state employee pension plan may also manage employee pension plans of local municipalities within that state. These asset owners would follow the guidance and requirements of the GIPS Standards for Asset Owners.

Some asset owners have the authority to compete for business by marketing to prospective clients, as traditional investment managers do. These asset owners would follow the guidance and requirements of the GIPS Standards for Firms, rather than the GIPS Standards for Asset Owners.

See Provisions 21.A.2 and 21.A.24 for guidance on when an asset owner competes for business.

Provision 21.A.2

An ASSET OWNER MUST be defined as an entity that manages investments, directly and/or through the use of EXTERNAL MANAGERS, on behalf of participants, beneficiaries, or the organization itself. These entities include, but are not limited to, public and private pension funds, endowments, foundations, family offices, provident funds, insurers and reinsurers, sovereign wealth funds, and fiduciaries.

Discussion

It is the asset owner’s responsibility to ensure that the definition of the asset owner is appropriate, rational, and fair, reflecting the organization or entity that has discretion over the total assets managed by the organization or entity. An asset owner’s definition will reflect the specific circumstances of the asset owner and how it manages investments, either directly and/or indirectly through the use of external managers. For a public pension fund, the asset owner is generally defined by legislation. In the case of foundations, endowments, or family offices, the asset owner would be the entity established by the governing body to manage the pool of assets. Asset owners claiming compliance must apply the GIPS standards to the entire entity defined as the asset owner.

There are situations in which an organization may act as both an asset owner, where investment authority and ownership are vested with the organization itself, as well as a firm (asset manager) that competes for assets whose vesting lies with external clients. In such cases, the asset owner has two choices in how to define itself for the purpose of complying with the GIPS standards.

- The asset owner bifurcates its assets into two entities: one defined as an asset owner and one defined as a firm.

- The asset owner does not bifurcate its assets and instead defines itself as both an asset owner and a firm. When calculating and presenting performance to the oversight body, the asset owner follows the GIPS Standards for Asset Owners. When calculating and presenting performance to prospective clients or prospective investors, the asset owner follows the GIPS Standards for Firms.

See Provision 21.A.24 for additional guidance on situations in which an asset owner competes for business, including those instances in which an asset owner acts as both an asset owner and a firm that competes for business.

Provision 21.A.3

The ASSET OWNER MUST have discretion over TOTAL FUND assets, either by managing assets directly or by having the discretion to hire and fire EXTERNAL MANAGERS.

Discussion

The GIPS standards are applicable only to asset owners that have discretion over total fund assets, either by managing assets internally and/or by having control over asset allocation decisions and the ability to hire and fire external managers. An external manager is a third-party investment manager that is hired by an asset owner to manage some or all of the total asset owner assets.

If the asset owner has discretion to assign assets to an external manager, those assets must be included in total asset owner assets. Once the assets are given to an external manager to manage, the asset owner will not have control over exactly how those assets are invested. Nevertheless, the asset owner chose to invest the assets by placing them with an external manager and has the discretion to hire and fire the external manager. Although the external manager is not required to comply with the GIPS standards, it may be helpful to the asset owner if the external manager is familiar with the GIPS standards.

Asset owners must treat the assets assigned to an external manager as they would other assets that are managed in-house and must include them in total asset owner assets, assign them to the appropriate total fund, and include them in the total fund performance calculation. The asset owner can include the assets managed by the external manager and the external manager’s performance record in the total fund only for the periods that the asset owner assigned the assets to the external manager.

Provision 21.A.4

To initially claim compliance with the GIPS standards, an ASSET OWNER MUST attain compliance for a minimum of one year or for the period since the ASSET OWNER inception if the ASSET OWNER has been in existence for less than one year.

Because of the unique nature of assets owners, in that they do not typically compete for clients, instead of requiring an initial five years of compliance with the GIPS standards as is required for firms, an asset owner must initially attain compliance for a minimum of one year or for the period since the asset owner inception if the asset owner has been in existence for less than one year. Importantly, this exception is allowed only for asset owners that do not compete for business. It applies only to asset owners that manage an entity’s assets solely for the purpose of supporting the organization and are accountable only to their respective oversight bodies.

Being in compliance for a minimum one-year period, or for the period since inception if less than one year, means that, for this period, the asset owner has complied with all applicable requirements of the GIPS standards, including any Guidance Statements, interpretations, and Questions & Answers (Q&As) published by CFA Institute and the GIPS standards governing bodies.

Assuming an asset owner initially attains compliance for the minimum one-year period, and the asset owner is presenting time-weighted returns (TWRs) in a GIPS Asset Owner Report, the asset owner is required to present one year of GIPS-compliant performance, or performance since inception of the total fund or composite if it has been in existence less than one year. A GIPS Asset Owner Report is a presentation for a total fund or composite that contains all the information required by the GIPS standards and may also include recommended information or supplemental information. The ability to present one year of GIPS-compliant performance does not mean, however, that the asset owner is able to claim compliance with the GIPS standards. The asset owner must fulfill all of the requirements of the GIPS standards for at least the initial one-year period or since inception if the asset owner has been in existence for less than one year, not simply the requirements relating to the presentation of performance in a GIPS Asset Owner Report.

An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report. If an asset owner has chosen to present a money-weighted return (MWR) for an additional composite in a GIPS Asset Owner Report, it is required to present only one return: the annualized since-inception MWR of the composite through the most recent annual period end. If the asset owner does not have records to support the track record since the composite’s inception date, the asset owner must present the composite’s annualized MWR for the longest period for which the asset owner has such records, through the most recent annual period end. Regardless of the period encompassed in this MWR, the asset owner cannot claim compliance with the GIPS standards until it has fulfilled all of the requirements of the GIPS standards, including but not limited to all of the input data and calculation requirements, for a full one-year period or since inception of the composite if the composite has been in existence for less than one year. If the composite has been in existence for longer than one year but the asset owner is initially claiming compliance with the GIPS standards for the minimum one-year period, the asset owner is still required to present the annualized MWR for the longest period for which the asset owner has records – not only for the period for which the asset owner claims compliance with the GIPS standards.

If an asset owner initially claims compliance for a period longer than one year, the asset owner must present a track record for the entire period for which it claims compliance. This condition applies whether the asset owner presents TWRs, MWRs, or both in its GIPS Asset Owner Reports.

Once an asset owner has claimed compliance for a one-year period, or since inception of the asset owner if the asset owner has existed for less than one year, the asset owner must include in GIPS Asset Owner Reports an additional year of performance each year, building up to a minimum of 10 years of GIPS-compliant performance. Although an asset owner is required to present only 10 years of performance in a GIPS Asset Owner Report, it is recommended that asset owners present more than 10 years of performance in a GIPS Asset Owner Report.

Consider the following examples of periods required to be presented when first claiming compliance with the GIPS standards and TWRs are presented.

- Example 1:

An asset owner has been in existence since 1 January 2011 and wishes to claim compliance starting with GIPS Asset Owner Reports for periods ending 31 December 2020. The asset owner decides to attain compliance for the minimum one-year period and chooses to present performance on a calendar-year basis. The asset owner has one total fund with a track record starting on 1 January 2011.

The asset owner must comply with all applicable requirements of the GIPS standards on an asset owner-wide basis for an initial one-year period, in this case from 1 January 2020 through 31 December 2020. The asset owner must prepare a GIPS Asset Owner Report that includes one year of GIPS-compliant performance for its total fund for the one-year period ended 31 December 2020. The asset owner must then continue to add one year of additional performance to its GIPS Asset Owner Report each year prospectively, building to a minimum of 10 years of GIPS-compliant performance. An asset owner is not required to present a track record longer than 10 years but is recommended to do so.

- Example 2:

An asset owner has been in existence since 2013 and wishes to claim compliance starting in 2020. For various reasons, the asset owner can create a GIPS-compliant track record only beginning 1 July 2019.

The asset owner may not claim compliance with the GIPS standards until it can present one year of GIPS-compliant performance. In this case, the asset owner must wait until it has GIPS-compliant returns from 1 July 2019 through 30 June 2020. Only then can the asset owner claim compliance with the GIPS standards. The asset owner must then continue to add one year of additional performance to its GIPS Asset Owner Reports each year, building to a minimum of 10 years of GIPS-compliant performance for each of its GIPS Asset Owner Reports. An asset owner is not required to present a track record longer than 10 years but is recommended to do so.

- Example 3:

A asset owner has been in existence for less than one year and has no annual total fund returns to report.

The asset owner may claim compliance with the GIPS standards as soon as it meets all of the applicable requirements of the GIPS standards and has performance to report. If the asset owner is less than 12 months old, it is permitted to present since-inception performance in a GIPS Asset Owner Report for its total fund and claim compliance with the GIPS standards. The asset owner must then continue to add one year of additional performance to its GIPS Asset Owner Reports each year, building to a minimum of 10 years of GIPS-compliant performance. An asset owner is not required to present a track record longer than 10 years but is recommended to do so.

Returns for periods of less than one year must not be annualized.

Provision 21.A.5

The ASSET OWNER MUST comply with all applicable requirements of the GIPS standards, including any Guidance Statements, interpretations, and Questions & Answers (Q&As) published by CFA Institute and the GIPS standards governing bodies.

Discussion

The GIPS standards are ethical standards for investment performance presentation to ensure fair representation and full disclosure of an asset owner’s performance. Asset owners must comply with all the requirements of the GIPS standards that apply to the asset owner, including requirements found within the provisions of the GIPS standards as well as within any Guidance Statements, interpretations, and Questions & Answers (Q&As) published by CFA Institute and the GIPS standards governing bodies. Asset owners must also comply with all updates and clarifications published by these entities. Asset owners must review all of the provisions and other requirements of the GIPS standards to determine each requirement’s applicability.

The GIPS standards must be applied with the objectives of full disclosure and fair representation of investment performance. Meeting the objectives of full disclosure and fair representation will likely require more than compliance with the minimum requirements of the GIPS standards. If an asset owner applies the GIPS standards in a performance situation that is not addressed specifically by the GIPS standards or is open to interpretation, disclosures other than those required by the GIPS standards may be necessary. To fully explain the performance included in a GIPS Asset Owner Report, asset owners are encouraged to present all relevant information, beyond required and recommended information, that will help the oversight body understand the information presented. Asset owners are also encouraged to adopt the recommendations included in the GIPS standards.

Provision 21.A.6

The ASSET OWNER MUST:

- Document its policies and procedures used in establishing and maintaining compliance with the REQUIREMENTS of the GIPS standards, as well as any RECOMMENDATIONS it has chosen to adopt, and apply them consistently.

- Create policies and procedures to monitor and identify changes and additions to all of the Guidance Statements, interpretations, and Q&As published by CFA Institute and the GIPS standards governing bodies.

Discussion

Policies and procedures are essential to implementing adequate business controls at all stages of the investment performance process – from data input to preparing materials for oversight bodies – to ensure the validity of the claim of compliance. An asset owner must document all of the policies and procedures it follows for meeting the requirements of the GIPS standards, as well as any recommendations the asset owner has chosen to adopt. There is no requirement to create and document policies and procedures to comply with requirements that do not apply to the asset owner. However, asset owners must actively make a determination about the applicability of all the requirements of the GIPS standards and document their policies and procedures accordingly.

Once an asset owner establishes its policies and procedures, it must apply them consistently. Policies and procedures should be reviewed regularly to determine if they should be changed or improved, but it is not expected that they will change frequently. An asset owner must not change a policy retroactively solely to enhance performance or to present the asset owner in a better light. Retroactive changes to policies and procedures should be avoided.

Asset owners must also create policies and procedures to monitor and identify changes and additions to all of the Guidance Statements, interpretations, Q&As, and any other guidance published by CFA Institute and the GIPS standards governing bodies. An asset owner should assign at least one person internally who is responsible for monitoring its compliance with the GIPS standards. Depending on the asset owner’s size and complexity, it might have a team of people responsible for GIPS compliance, and maintaining compliance may require coordination across multiple departments, including but not limited to operations, performance, portfolio management, and compliance.

Provision 21.A.7

The ASSET OWNER MUST:

- Comply with all applicable laws and regulations regarding the calculation and presentation of performance.

- Create policies and procedures to monitor and identify changes and additions to laws and regulations regarding the calculation and presentation of performance.

Discussion

The GIPS standards provide an ethical framework for calculating and presenting an asset owner’s investment performance history. Asset owners must also comply with all applicable laws and regulations regarding the calculation and presentation of performance. Asset owners must create policies and procedures to ensure that they adhere to all applicable laws and regulations regarding the calculation and presentation of performance. Asset owners must also have policies and procedures to identify and monitor changes and additions to laws and regulations regarding the calculation and presentation of performance.

Compliance with applicable laws and regulations does not necessarily result in compliance with the GIPS standards. Asset owners claiming compliance must comply with the GIPS standards in addition to all applicable laws and regulations. In the rare cases when laws and regulations conflict with the GIPS standards, asset owners are required to comply with the laws and regulations and disclose the manner in which the laws or regulations conflict with the GIPS standards.

Provision 21.A.8

The ASSET OWNER MUST NOT present performance or PERFORMANCE-RELATED INFORMATION that is false or misleading. This REQUIREMENT applies to all performance or PERFORMANCE-RELATED INFORMATION on an ASSET OWNER-wide basis and is not limited to those materials that reference the GIPS standards. The ASSET OWNER may provide any performance or PERFORMANCE-RELATED INFORMATION that is specifically requested by the OVERSIGHT BODY.

Discussion

The underlying principles of the GIPS standards, fair representation and full disclosure, help to ensure that oversight bodies are not given performance or performance-related information that is incomplete, inaccurate, biased, or fraudulent. Asset owners must not present any performance or performance-related information that is known to be inaccurate or that may mislead the oversight body. This concept applies to all performance or performance-related materials on an asset owner-wide basis and is not limited to those materials that reference the GIPS standards. An example of information that is misleading is model performance that is presented as actual performance.

Asset owners are not limited to providing only GIPS-compliant information to oversight bodies. Asset owners may present other performance or performance-related information as long as it is not false or misleading.

The following information has an especially high risk of being interpreted by oversight bodies in a way that is likely to be false and misleading:

- Actual performance linked to model, hypothetical, backtested, or simulated historical results; and

- Performance compared with an inappropriate benchmark.

This information must not be presented in a GIPS Asset Owner Report.

Outside of a GIPS Asset Owner Report, an asset owner may present this information if asked to do so by the oversight body. The information may be presented in a presentation that is created for and will be used only by the oversight body.

An asset owner may wish to present performance for select periods, other than the period(s) required and recommended by the GIPS standards. For example, if the market experienced a sharp decline during the first two months of the calendar year and became more stable in March, the asset owner may want to show performance of its strategy from 1 January through 28 February and from 1 March through 31 December. If the performance for these select periods is presented in addition to the performance for the required periods, it may be presented in a GIPS Asset Owner Report. This presentation is permitted because the select periods are being presented in addition to the required periods. To present only performance for the select periods without performance for the required periods, especially if the select periods were chosen because the periods had the highest performance, would be false and misleading and is not permitted for asset owners that claim compliance with the GIPS standards. Asset owners may present performance for select periods outside of GIPS Asset Owner Reports with the appropriate disclosure and labeling.

The asset owner may provide to an oversight body any information requested by the oversight body. Such information must be accompanied by comprehensive disclosures that explain the information being presented.

Provision 21.A.9

If the ASSET OWNER does not meet all the applicable REQUIREMENTS of the GIPS standards, the ASSET OWNER MUST NOT represent or state that it is “in compliance with the Global Investment Performance Standards except for…” or make any other statements that may indicate compliance or partial compliance with the GIPS standards.

Discussion

When the asset owner makes the claim of compliance with the GIPS standards, it is representing that all of the applicable requirements of the GIPS standards have been met on an asset ownerwide basis. Either an asset owner meets all of the applicable requirements of the GIPS standards and may claim compliance, or an asset owner does not meet all of the applicable requirements of the GIPS standards and must not claim compliance or partial compliance with the GIPS standards. If the asset owner does not meet all the applicable requirements of the GIPS standards, the asset owner must not represent or state that it is “in compliance with the Global Investment Performance Standards except for…” or make any other statements that may indicate compliance or partial compliance with the GIPS standards.

Provision 21.A.10

Statements referring to the calculation methodology as being “in accordance,” “in compliance” or “consistent” with the Global Investment Performance Standards, or similar statements, are prohibited.

Discussion

Only asset owners that manage actual assets may claim compliance with the GIPS standards. For asset owners that do manage actual assets, either directly or by having the discretion to hire and fire external managers, compliance can be achieved only when the asset owner has met all of the applicable requirements of the GIPS standards on an asset owner-wide basis. Compliance with the GIPS standards involves more than just the use of a particular calculation methodology. To avoid any confusion, references to the GIPS standards must not be used in the context of reporting performance or performance presentations when the asset owner is not in compliance with the GIPS standards.

Software vendors, custodians, and other service providers do not manage actual assets and cannot claim compliance with the GIPS standards. They may make reference to the fact that their software or services may help an asset owner achieve or maintain compliance with the GIPS standards, if that is the case. For example, a software vendor may state that its software system calculates performance that satisfies the calculation requirements of the GIPS standards, but the vendor must not state or imply that using its system automatically makes an asset owner compliant with the GIPS standards or that its system complies with the GIPS standards.

Provision 21.A.11

The ASSET OWNER MUST:

- Provide a GIPS ASSET OWNER REPORT for all TOTAL FUNDS and any additional COMPOSITES that have been created to the OVERSIGHT BODY.

- Provide an updated GIPS ASSET OWNER REPORT for all TOTAL FUNDS and any additional COMPOSITES that have been created to the OVERSIGHT BODY at least once every 12 months.

Discussion

A GIPS Asset Owner Report is defined as an asset owner’s presentation for a total fund or composite that contains all the information required by the GIPS standards and may also include recommended information or supplemental information. An oversight body is defined as those who have direct oversight responsibility for total fund assets and total asset owner assets. Asset owners claiming compliance with the GIPS standards must provide the respective oversight body with a GIPS Asset Owner Report for each total fund that it manages, as well as a GIPS Asset Owner Report for any additional composites the asset owner has chosen to create. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.) An updated GIPS Asset Owner Report for all total funds and any additional composites must be provided to the oversight body at least once every 12 months. Asset owners are not required to present all composites, including those used for internal reporting purposes, in a GIPS Asset Owner Report. Asset owners must provide a GIPS Asset Owner Report to the oversight body only for those additional composites that the asset owner has chosen to create and present in a GIPS Asset Owner Report.

If an asset owner manages more than one total fund according to the same investment strategy, the asset owner has a choice regarding how the total funds are presented to the oversight body. The asset owner may choose to present each total fund separately to the oversight body, creating a separate GIPS Asset Owner Report for each total fund. Alternatively, the asset owner may include all total funds managed according to the same investment strategy in one total fund composite and create one GIPS Asset Owner Report for the total fund composite to present to the oversight body.

If the asset owner has more than one oversight body, or manages assets on behalf of another organization, each GIPS Asset Owner Report must be provided to the respective oversight body.

Because an asset owner is required to demonstrate that it provided the oversight body with the required GIPS Asset Owner Reports (see Provision 21.A.14), an asset owner should establish policies and procedures for tracking which GIPS Asset Owner Reports were provided to the oversight body and any other entities and when they were provided. Doing so will allow an asset owner to determine when the oversight body must receive an updated GIPS Asset Owner Report. It will also allow an asset owner to know who must receive a corrected GIPS Asset Owner Report in cases for which the asset owner determines that a previously distributed GIPS Asset Owner Report contained a material error. (See Provision 21.A.16.)

Asset owners that wish to distribute a GIPS Asset Owner Report more broadly may include it on their websites and in their annual reports, newsletters, and other distributed materials. Asset owners may also refer to their claim of compliance with the GIPS standards on their websites and in their annual reports, newsletters, and other distributed materials in accordance with the GIPS Advertising Guidelines. (See Section 26 for the GIPS Advertising Guidelines.)

Asset owners are not limited to providing only GIPS Asset Owner Reports to their oversight bodies. Asset owners may present other performance or performance-related information, in addition to the GIPS Asset Owner Report, as long as it is not false or misleading. Asset owners may also provide any performance or performance-related information their oversight bodies request. Such information must be accompanied by comprehensive disclosures that explain the information being presented.

Provision 21.A.12

The ASSET OWNER may provide a GIPS ASSET OWNER REPORT to those who have a more indirect fiduciary role but is not required to do so.

Discussion

Asset owners are not required to provide a GIPS Asset Owner Report to those who have a more indirect fiduciary role, such as a member of the legislative body that drafts the legislation establishing a public pension plan, but may do so if they wish. For those total funds that have beneficiaries or regulators, the asset owner should provide a GIPS Asset Owner Report to the beneficiaries or regulators upon request. Asset owners are required to comply with all applicable laws and regulations regarding the calculation and presentation of performance.

Provision 21.A.13

When providing GIPS ASSET OWNER REPORTS to an OVERSIGHT BODY, the ASSET OWNER MUST update these reports to include information through the most recent annual period end within 12 months of that annual period end.

Discussion

GIPS Asset Owner Reports are designed to provide information to oversight bodies that will help them understand the investment mandate, characteristics, and performance of the total fund(s) and any additional composites that have been created by the asset owner. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.) Although a GIPS Asset Owner Report contains important information, the value and relevance of that information are affected by the timeliness with which the GIPS Asset Owner Report is updated. A GIPS Asset Owner Report that presents returns that are significantly out of date is not helpful to the oversight body. It is therefore required that any GIPS Asset Owner Report that is provided to an oversight body must be updated within 12 months of the end of the most recent annual period end. It is recommended that GIPS Asset Owner Reports be updated quarterly to provide more timely information to the asset owner’s oversight body (see Provision 21.B.2).

As an example, suppose that an asset owner presents calendar-year returns in GIPS Asset Owner Reports. GIPS Asset Owner Reports with information through 31 December 2020 must be available no later than 31 December 2021. The lack of the completion of an annual verification is not a valid reason for delaying the updating of a GIPS Asset Owner Report.

Provision 21.A.14

The ASSET OWNER MUST be able to demonstrate how it provided GIPS ASSET OWNER REPORTS to the OVERSIGHT BODY.

Discussion

Asset owners are required by the GIPS standards to provide GIPS Asset Owner Reports to their oversight bodies. Asset owners are also required to have policies and procedures in place that are used to establish and maintain compliance with the requirements of the GIPS standards. Therefore, an asset owner claiming compliance with the GIPS standards must have specific policies and procedures to ensure that the required GIPS Asset Owner Report(s) have been provided to the oversight body. These should include policies and procedures for tracking which GIPS Asset Owner Reports were provided to the oversight body and when. For example, an asset owner’s policies and procedures might specify that the required GIPS Asset Owner Report(s) will be included as part of the standard package of materials prepared for the oversight body, and that a checklist will be used to indicate the dates on which a GIPS Asset Owner Report was provided to the oversight body and which version of the GIPS Asset Owner Report was provided. Documenting the date on which the GIPS Asset Owner Report was last provided to the oversight body, as well as which version was provided, will help an asset owner fulfill the requirement to provide the required GIPS Asset Owner Report(s) to the oversight body at least once every 12 months. The most effective policies and procedures for an asset owner will depend on the circumstances surrounding the typical interactions between the asset owner and the oversight body.

To demonstrate that the asset owner provided the GIPS Asset Owner Report to the oversight body, it is necessary for the asset owner to document both the relevant policies and procedures for providing the required reports to the oversight body and the steps taken to implement the relevant policies and procedures.

Provision 21.A.15

A BENCHMARK used in a GIPS ASSET OWNER REPORT MUST reflect the investment mandate, objective, or strategy of the TOTAL FUND OR COMPOSITE. The ASSET OWNER MUST NOT USE a price-only BENCHMARK in a GIPS ASSET OWNER REPORT.

Discussion

Benchmarks are important tools that aid in the planning, implementation, and evaluation of a total fund’s or additional composite’s investment policy. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.) They also help facilitate discussions with an asset owner’s oversight body regarding the relationship between risk and return. As a result, asset owners are required to present the total return for a benchmark that reflects the total fund’s or additional composite’s investment mandate, objective, or strategy in all GIPS Asset Owner Reports.

GIPS Asset Owner Reports that include time-weighted returns must include total fund or additional composite returns for each annual period. GIPS Asset Owner Reports that include money-weighted returns must include the additional composite return for the longest period for which the asset owner has records through the most recent annual period end. Asset owners must present benchmark returns for these required periods and for any additional periods for which total fund or additional composite returns are presented. For example, if a GIPS Asset Owner Report includes quarterly total fund returns, quarterly benchmark returns must also be included.

The benchmark that appears in a GIPS Asset Owner Report may be different from the bench-mark(s) used for the portfolios that are included in the total fund or additional composite. For example, an asset owner may decide that it is appropriate to include portfolios with different benchmarks in the same additional composite. Additionally, an asset owner may present more than one benchmark in a GIPS Asset Owner Report. The asset owner must determine the appropriate benchmark or benchmarks for each total fund and additional composite.

There may be situations in which there is no appropriate benchmark for a total fund, total fund composite, or an additional composite – that is, no benchmark exists that reflects the total fund’s, total fund composite’s, or additional composite’s investment mandate, objective, or strategy. In such cases, the asset owner must not present a benchmark in the GIPS Asset Owner Report and must disclose why no benchmark is presented.

Because the GIPS standards require that the total return for the benchmark be presented, a price-only index would not satisfy the requirements of the GIPS standards. This also applies to benchmarks that are components of a blended benchmark. A blended benchmark is the combination of two or more indexes, such as a benchmark that consists of 50% of the ABC Index and 50% of the DEF Index. In this example, both the ABC Index and the DEF Index must be total return benchmarks, not price-only benchmarks. However, when there is an appropriate total return benchmark, a price-only benchmark may be presented in a GIPS Asset Owner Report as supplemental information, as well as outside of a GIPS Asset Owner Report, if the price-only benchmark is accompanied by a total return benchmark. If a price-only benchmark is included in a GIPS Asset Owner Report as supplemental information or presented outside of a GIPS Asset Owner Report, it must be identified as a price-only benchmark, and there must be sufficient disclosures so that an oversight body understands the difference between the return of a price-only benchmark and the return of a total return benchmark. If no appropriate total return benchmark exists, the asset owner may not present a price-only benchmark in a GIPS Asset Owner Report but may present it outside of a GIPS Asset Owner Report. In such cases, “price only” must be included in the label or the name of the benchmark. As in all cases where a price-only benchmark is presented, there must be sufficient disclosures so that an oversight body understands the difference between the return of a price-only benchmark and the return of a total return benchmark.

Some benchmarks may appear to be price-only benchmarks because they do not include income, but they should be considered total return benchmarks. These include the following:

- public market equivalent (PME) benchmarks,

- commodity benchmarks, and similar benchmarks, that do not have income because of the nature of the benchmark constituents, and

- target returns, such as an 8% hurdle rate.

Please refer to Provision 25.C.28 for more information on PME benchmarks.

Provision 21.A.16

The ASSET OWNER MUST correct MATERIAL ERRORS in GIPS ASSET OWNER REPORTS and MUST:

- Provide the corrected GIPS ASSET OWNER REPORT to the current verifier.

- Provide the corrected GIPS ASSET OWNER REPORT to any former verifiers that received the GIPS ASSET OWNER REPORT that had the MATERIAL ERROR.

- Provide the corrected GIPS ASSET OWNER REPORT to any OVERSIGHT BODY that received the GIPS ASSET OWNER REPORT that had the MATERIAL ERROR.

Discussion

Asset owners claiming compliance with the GIPS standards are likely to face situations in which errors are discovered that must be specifically addressed. Even with the tightest of controls, errors will occur. An error, which can be qualitative or quantitative, is any component of a GIPS Asset Owner Report that is missing or inaccurate. Errors in GIPS Asset Owner Reports can result from, but are not limited to, incorrect, incomplete, or missing:

- total fund or composite returns or assets,

- asset owner assets,

- benchmark returns,

- number of portfolios in a composite,

- three-year annualized ex post standard deviation, and

- disclosures.

Asset owners must establish error correction policies and procedures, and materiality must be defined in the error correction policies.

If a GIPS Asset Owner Report contains a material error, the GIPS Asset Owner Report must be corrected and the corrected GIPS Asset Owner Report that includes a disclosure of the error must be provided to the current verifier and to any former verifiers that received the GIPS Asset Owner Report with the material error. Former verifiers that received the GIPS Asset Owner Report with the material error must receive the corrected GIPS Asset Owner Report with a disclosure of the error in case the error affects a previously issued verification report or performance examination report. The asset owner must also provide the corrected GIPS Asset Owner Report to any oversight body that received the GIPS Asset Owner Report that had the material error.

The asset owner generally has three options for dealing with non-material errors in GIPS Asset Owner Reports:

- Take no action.

The error is deemed immaterial and does not require a change to any data or disclosures in the GIPS Asset Owner Report. - Correct the GIPS Asset Owner Report with no disclosure of the change and no distribution of the corrected GIPS Asset Owner Report.

The correction of the error results in a change to one or more items in the GIPS Asset Owner Report, but these changes are deemed not material and therefore do not require disclosure of the change or distribution of the corrected GIPS Asset Owner Report. - Correct the GIPS Asset Owner Report with disclosure of the change and no distribution of the corrected GIPS Asset Owner Report.

The correction of the error results in a change to one or more items in the GIPS Asset Owner Report, but these changes are deemed not material. The asset owner does not distribute the corrected GIPS Asset Owner Report but, according to the asset owner’s pre-established error correction policies and procedures, the error does require disclosure in the corrected GIPS Asset Owner Report.

An asset owner must decide what criteria it will use to determine materiality. The following is a definition of materiality that asset owners might find useful as a starting point:

An error (or item) is material if the magnitude of the omission or misstatement of performance information, in light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed by the omission or misstatement.

When determining materiality, an asset owner may consider the following factors:

- magnitude of the error, in absolute and relative terms,

- whether the error is material relative to the benchmark,

- whether returns are overstated or understated,

- significance of the missing or incorrect disclosures,

- whether the error affects returns over time or is a timing issue,

- period(s) affected by the error,

- if these policies will be applied asset owner-wide or on a total fund-specific or composite-specific basis, and

- whether the asset owner has any legal or regulatory obligations related to error correction.

The size and effect of the error may vary for different asset types (e.g., equities, fixed income, emerging market equities), reporting periods (e.g., monthly, quarterly, or annual returns), and by time period (e.g., prior to a specific date, more than five years ago).

It is important to remember that the omission of required information is considered an error, as well as a misstatement in the information presented. The GIPS Asset Owner Report must be corrected to include the required information, and the asset owner must apply its error correction policies to determine if the error is material.

Asset owners must establish and document error correction policies and procedures and must implement them consistently. An asset owner should strive to create an unambiguous process that includes specific steps to discover errors.

Provision 21.A.17

The ASSET OWNER MUST maintain a complete list of TOTAL FUND DESCRIPTIONS and COMPOSITE DESCRIPTIONS for any COMPOSITE that has been presented in a GIPS ASSET OWNER REPORT. The ASSET OWNER MUST include terminated TOTAL FUNDS and COMPOSITES on this list for at least five years after the TOTAL FUND TERMINATION DATE OR COMPOSITE TERMINATION DATE. If the ASSET OWNER has only one REQUIRED TOTAL FUND and has not chosen to create any additional COMPOSITES, the GIPS ASSET OWNER REPORT for the TOTAL FUND may be used.

Discussion

Asset owners must maintain a complete list of total fund descriptions and composite descriptions for any total fund, total fund composite, or additional composite that has been presented in a GIPS Asset Owner Report. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.) If the asset owner has only one total fund or only one total fund composite and has not chosen to create any additional composites, the GIPS Asset Owner Report for the total fund or the total fund composite represents the asset owner’s list of total fund and composite descriptions. This is because the composite description in the GIPS Asset Report for the total fund or the total fund composite is required to be included in the GIPS Asset Owner Report, and the GIPS Asset Owner Report can be used to meet this requirement. If the asset owner chooses to create additional composites representing one or more strategies within a total fund, or the asset owner has more than one required GIPS Asset Owner Report for its total funds, a list of total fund descriptions and composite descriptions must be maintained.

If the asset owner competes for business and claims compliance with the GIPS standards when doing so, this list must also include the strategies that the asset owner uses when it competes for business.

Asset owners must include terminated total funds and terminated composites on the asset owner’s list of total fund descriptions and composite descriptions for at least five years after the total fund termination date or composite termination date.

The total fund description or composite description is general information regarding the investment mandate, objective, or strategy of the total fund or composite. The description must include enough information to allow the oversight body to understand the key characteristics of the total fund’s or composite’s investment mandate, objective, or strategy, including the risks of the strategy; how leverage, derivatives, and short positions are used if they are a material part of the strategy; and whether or not illiquid assets are a material part of the strategy. In addition to these factors, the total fund description is expected to include the following:

- the total fund’s asset allocation as of the most recent annual period end,

- the actuarial rate of return or spending policy description, and

- a description of the asset classes and/or other groupings within the total fund, such as the composition of the asset class, strategy used, types of management used (e.g., active, passive, internal, external), and relevant exposures.

A total fund description or composite description must include the material risks of the total fund’s or composite’s strategy. All investment products or strategies have some degree of inherent common risk, such as, but not limited to, market, currency, investment-specific, inflation, or interest rate risk. Asset owners may include these generic, systemic risks in a total fund description or composite description but are not required to do so. It is not expected that the total fund description or composite description will include reference to every one of these generic, systemic risks unless any is materially more significant to a total fund strategy or composite strategy than typically expected. The following are some of the risks that should be discussed in a total fund description or composite description if the risks could have had significant influence on the historical returns or are a key feature of the strategy and need to be considered alongside future expected returns:

- liquidity risk,

- leverage and derivatives risk,

- credit/issuer risk,

- counterparty risk,

- interest rate risk, and

- currency risk.

Some strategies can be highly volatile or may be profoundly affected by market-driven events. Asset owners are reminded that total fund descriptions and composite descriptions must reflect material changes in the risks of the strategies that would be caused by market events or changes imposed by the asset owner.

A sample list of total fund descriptions and composite descriptions is provided in Appendix D of the GIPS standards.

Provision 21.A.18

The ASSET OWNER MUST provide the complete list of TOTAL FUND DESCRIPTIONS and COMPOSITE DESCRIPTIONS to the OVERSIGHT BODY if it makes such a request. If the ASSET OWNER has only one REQUIRED TOTAL FUND and has not chosen to create any additional COMPOSITES, the GIPS ASSET OWNER REPORT for the TOTAL FUND may be used.

Discussion

In addition to maintaining a complete list of total fund descriptions and composite descriptions, as applicable to the asset owner, asset owners must provide this list to the oversight body upon request. If the asset owner has only one required total fund or only one required total fund composite, and has not chosen to create any additional composites, the GIPS Asset Owner Report for the total fund or the total fund composite may be used. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.)

Although asset owners are required to provide the complete list of total fund descriptions and composite descriptions to the oversight body upon request, they are encouraged to provide this information to anyone else who makes the request.

Provision 21.A.19

All data and information necessary to support all items included in GIPS ASSET OWNER REPORTS and GIPS ADVERTISEMENTS MUST be captured, maintained, and available within a reasonable time frame, for all periods presented in these reports and advertisements.

Discussion

A fundamental principle of the GIPS standards is the need for asset owners to be able to ensure the validity of their claim of compliance. It is, therefore, important for oversight bodies, verifiers, and regulators to have confidence that all items included in a GIPS Asset Owner Report or GIPS Advertisement are supported by the appropriate records.

Asset owners must maintain records to be able to recalculate their performance history as well as substantiate all other information, including supplemental information, included in a GIPS Asset Owner Report or GIPS Advertisement, for all periods shown. This requirement applies regardless of the period for which performance is presented in the GIPS Asset Owner Report or GIPS Advertisement (e.g., 1 year, 5 years, 10 years, or more than 10 years). This requirement is consistent with the regulatory requirements of many countries. In some jurisdictions, however, regulators require records to be kept for longer periods than those required by the GIPS standards. Care should be taken to ensure that the asset owner follows the strictest of the recordkeeping requirements applicable to the asset owner.

It is understood that the required data may not be immediately available. For example, data may need to be retrieved from an offsite location or from a third-party service provider.

However, the data and information required to be maintained by this provision must be available in a usable format within a reasonable time frame. In all instances, either paper (hard-copy) records or electronically stored records will suffice. If records are stored electronically, the records must be accessible and able to be printed or downloaded, if needed. Records stored in a system that is not operable and from which data cannot be retrieved will not satisfy the recordkeeping requirements.

Although most asset owners are looking for a very precise list of the minimum documents that must be maintained to support all parts of the GIPS Asset Owner Report or GIPS Advertisement, including the ability to recalculate the asset owner’s performance history, there is no single list of records that will suffice in all situations. Each asset owner must determine for itself which records must be maintained. The following lists include records that asset owners should consider maintaining to meet the recordkeeping requirements of this provision. None of these lists should be considered exhaustive. The actual records required will depend on the asset owner’s particular circumstances.

Records to Support Portfolio-Level Returns

- portfolio statements, including positions and valuations, as well as information supporting the determination of fair value,

- information to prove that performance is based on actual assets, including bank/custodial statements and reconciliations,

- portfolio transactions reports,

- outstanding trades reports,

- corporate action reports,

- income received/earned reports,

- accrued income reports,

- foreign or other withholding tax reclaim reports,

- cash flow/weighted cash flow reports,

- foreign exchange rates,

- information on calculation methodology used,

- information provided by a third party (e.g., an external manager or custodian) for which an asset owner may need to take additional steps to ensure the information can be relied on to meet the requirements of the GIPS standards,

- investment management fee information, and

- pooled fund profit and loss allocation reports.

Records to Support Total Fund and Composite-Level Returns and Other Total Fund and Composite-Level Data

- portfolios included in the total fund or composite,

- when each portfolio entered (and exited, if applicable) the total fund or composite,

- each portfolio’s return for each period, and

- value used to weight each portfolio (beginning value or beginning value plus weighted external cash flows) for each period,

- number of total funds or portfolios in the composite and the total fund or composite assets as of each annual period end and any other period for which this information is presented in GIPS Asset Owner Reports,

- support for investment management costs used to calculated net-of-fees returns, and support for the three-year annualized ex post standard deviation calculation and any additional risk measures, and

- exchange rates used to convert investments or returns from different currencies.

Records to Support the Inclusion of a Total Fund or Portfolio in a Specific Composite

- total fund or composite definition,

- investment management agreements and investment guidelines for externally managed portfolios, as well as amendments thereto, and

- documentation regarding changes to a total fund’s or portfolio’s investment mandate, objective, or strategy.

Records to Support Other Information Included in a GIPS Asset Owner Report

- composite cumulative committed capital,

- composite since-inception paid-in-capital,

- composite since-inception distributions,

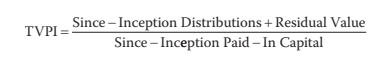

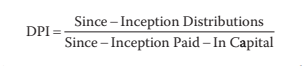

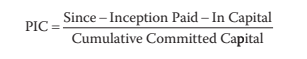

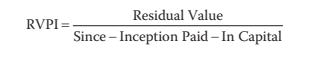

- composite investment multiple, realization multiple, PIC multiple, and unrealized multiple,

- audited financial statements,

- investment management fee schedules charged by external managers,

- pooled fund expense ratio and investment management fee schedules charged by external managers, if full gross-of-fees returns are calculated,

- performance-fee calculations for performance fees paid to external managers,

- benchmark returns, including custom benchmark calculations,

- estimated transaction costs, and

- supplemental information.

Records to Support an Asset Owner’s Claim of Compliance

- GIPS standards policies and procedures, covering all periods for which the asset owner claims compliance with the GIPS standards,

- definition of the asset owner, historically and current,

- supporting calculation for total asset owner assets as of each annual period end and any other period for which total asset owner assets are presented in GIPS Asset Owner Reports,

- total fund and composite inception dates and composite creation dates,

- list of total fund descriptions and composite descriptions, and

- GIPS Asset Owner Reports for all total funds, total fund composites, and additional composites (an additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report).

Any Additional Records Necessary to Support a Claim of Compliance

- system and control reports from independent accountants or other third parties (e.g., accounting reports, other internal controls/compliance reports for custodians),

- third-party (e.g., external manager, custodial, performance data provider) agreements,

- minutes of relevant decision-making committees (e.g., a board, an investment committee, a GIPS compliance committee),

- systems manuals, especially for the systems that generate the portfolio, total fund, and composite returns, as well as for GIPS Asset Owner Reports (including both numerical information and disclosures),

- documentation of providing GIPS Asset Owner Reports to the oversight body,

- documentation that the asset owner followed its error correction policy, including providing, in the case of a material error, a corrected GIPS Asset Owner Report, including disclosure of the error, to all appropriate parties in accordance with the asset owner’s error correction policy,

- underlying benchmark data (if not publicly available), and

- documentation of providing the following to any oversight body that requested:

- a list of total fund descriptions and composite descriptions,

- portfolio-weighted custom benchmark component weights for prior periods,

- policies for valuing portfolios,

- policies for calculating performance,

- policies for preparing GIPS Asset Owner Reports,

- verification report(s), and

- performance examination report(s).

It is expected that all asset owners will have disaster recovery plans to mitigate the loss of records for any reason, whether it is a catastrophic event beyond the control of the asset owner or a situation within the control of the asset owner. If an asset owner that claims compliance with the GIPS standards experiences a catastrophic event that destroys all of its records and electronic or other backup systems, the asset owner should try to reconstruct the necessary information by obtaining the information from custodians, consultants, verifiers, or any other party outside the asset owner that might have duplicate copies of those records. If the underlying data to support the GIPS Asset Owner Report was destroyed because of extreme circumstances beyond the asset owner’s control and is unavailable from other sources, however, the asset owner may continue to claim compliance and show performance if the lack of records for the unavailable period(s) is disclosed.

For example, assume Asset Owner A claims compliance with the GIPS standards, and the records for Asset Owner A from its inception on 1 January 2017 through 31 December 2017 were destroyed under extreme circumstances beyond the asset owner’s control. The asset owner can continue to claim compliance with the GIPS standards for that period but must disclose that the asset owner’s records for the period from 1 January 2017 through 31 December 2017 were destroyed under extreme circumstances beyond the asset owner’s control and the data are unavailable from other sources. The asset owner must also consider any applicable regulatory requirements and must remember that the GIPS standards are ethical standards based on the principles of fair representation and full disclosure. Any performance information that is presented must adhere to these principles.

Asset owners that have not yet claimed compliance with the GIPS standards and want to do so but do not have records to support the recordkeeping requirements because they experienced a catastrophic event in the past cannot take advantage of this exception from the recordkeeping requirement. They cannot claim compliance until they have complied with all the requirements of the GIPS standards, including the requirement to have the records to support at least a one-year performance track record.

All asset owners are reminded that, above all else, they must follow all applicable laws and regulations regarding the calculation and presentation of performance, including all recordkeeping requirements.

Provision 21.A.20

The ASSET OWNER is responsible for its claim of compliance with the GIPS standards and MUST ensure that the records and information provided by any third party on which the ASSET OWNER relies meet the REQUIREMENTS of the GIPS standards.

Discussion

An asset owner that claims compliance with the GIPS standards is responsible for its claim of compliance. Therefore, an asset owner that uses a third party to provide any service (e.g., custody, external management, performance measurement), and relies on that service, must ensure that the records and information provided by the third-party service provider meet the requirements of the GIPS standards. The asset owner is responsible for ensuring that the data received from various external sources is accurate and must be able to aggregate any information supplied by external service providers as needed. An asset owner should carefully research any third-party service provider and should engage only reputable service providers.

It is acknowledged that, in some cases, it may be challenging to obtain information from a third party that meets the requirements of the GIPS standards. An asset owner has the option of bringing performance in house rather than relying on a third party. An asset owner can also make adjustments to the information provided by a third party so that it meets the requirements of the GIPS standards. For example, if an asset owner received composite data from a third party, and the third party weighted portfolio returns by ending value instead of beginning value, the asset owner could weight the returns itself using beginning-of-period values to calculate composite returns. As another example, suppose that a custodian reflects interest income on a cash basis. The asset owner may make adjustments to the income information from the custodian to properly reflect accrued income.

When using third-party service providers, asset owners are encouraged to ensure that adequate service-level agreements are in place to provide the historical records necessary, both currently and as needed in the future. It may be helpful to partner with custodians, external managers, and other service providers that understand what is needed to comply with the GIPS standards.

Asset owners must establish policies and procedures to ensure that third-party information, such as the information provided by a custodian or an external manager, adheres to the requirements of the GIPS standards, if the asset owner relies on that information. A thorough examination of third-party service providers’ policies and procedures should be conducted when they are hired. It is recommended that asset owners that claim compliance with the GIPS standards conduct periodic testing or other monitoring procedures that ensure that the policies and procedures of any third-party service provider on which the asset owner relies have not changed since the service provider was first hired and are being applied consistently and appropriately.

Finally, this provision does not require the asset owner to “look through” net asset value (NAV) valuations of externally managed pooled funds. Asset owners may rely on NAVs of pooled funds that reflect the fund’s tradable value and use that as the pooled fund’s fair value.

Provision 21.A.21

The ASSET OWNER MUST NOT LINK actual performance to historical THEORETICAL PERFORMANCE.

Discussion

Theoretical performance is a broad term encompassing different types of performance that is not derived from a total fund, composite, or portfolio with actual assets invested in the strategy or fund presented (“non-actual” performance). There are several names for this type of information: model, backtested, hypothetical, simulated, indicative, and forward-looking, among others. Asset owners may present theoretical performance but, within a GIPS Asset Owner Report, historical theoretical performance must not be linked to the performance of a total fund or composite that includes actual portfolios. As an example, an asset owner that has a composite with a one-year track record must not extend the history to five years using backtested performance for four years linked to the actual one-year performance. As a second example, a composite that lost all its constituent portfolios for two months cannot continue the track record without interruption by using the benchmark return for the missing months of performance to simulate performance. In this case, the asset owner also cannot link the periods prior to the break and after the break to create a continuous track record as if there was no break. Historical total fund or composite returns must represent performance of only actual discretionary assets managed by the asset owner.

Theoretical performance, such as simulated or model performance, may be included in a GIPS Asset Owner Report. If theoretical performance is included in a GIPS Asset Owner Report, it must not be linked to actual performance and must be clearly labeled as supplemental information. Theoretical performance should be provided only to those parties who are sufficiently experienced and knowledgeable to assess the relevance and limitations of theoretical performance.

Outside of a GIPS Asset Owner Report, asset owners may present actual performance linked to historical theoretical performance to the oversight body. The linked information may be presented in a presentation that is created for and will be used only by the oversight body. There must be sufficient disclosures regarding the linked performance so that the oversight body understands the relevance and limitations of the information.

Provision 21.A.22

Changes in an ASSET OWNER’S organization MUST NOT lead to alteration of historical performance.

Discussion

Over time, the organization of an asset owner may change. Regardless of the reason for the change in the asset owner’s organization, historical total fund or composite performance must remain part of the asset owner’s history. In considering issues regarding the use of historical performance, it is important to remember that performance is the record of the asset owner, not of the individual. For example, suppose that a sole investment decision maker for a portfolio managed internally leaves the asset owner and the new portfolio manager continues to manage the portfolio according to the same investment mandate or strategy as the previous portfolio manager. The asset owner must link the historical performance of the portfolio to the ongoing performance achieved by the new portfolio manager.

Provision 21.A.23

The ASSET OWNER MUST NOT present non-GIPS-compliant performance in GIPS ASSET OWNER REPORTS.

Discussion

Only GIPS-compliant performance is allowed to be presented in a GIPS Asset Owner Report. Outside of a GIPS Asset Owner Report, asset owners may present their entire performance history, which may include both non-compliant and compliant performance.

As an example for presenting time-weighted returns, suppose that an asset owner with a six-year track record is newly coming into compliance with the GIPS standards. The asset owner has elected to bring only one year of its performance history into compliance. The asset owner may present the entire six-year track record outside of a GIPS Asset Owner Report by linking the compliant and the non-compliant track record. However, the GIPS Asset Owner Report must include only the portion of the track record that is compliant with the GIPS standards.

When presenting money-weighted returns (MWRs) for an additional composite in a GIPS Asset Owner Report, the asset owner must not present non-GIPS-compliant performance. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.) The measurement period for the MWR is from inception of the composite through the most recent annual period end. If the asset owner does not have the records to support the track record from the composite’s inception through the most recent annual period end, the asset owner must present the annualized MWR for the longest period for which the asset owner has such records, through the most recent annual period end. All inputs to the MWR calculation must meet any applicable requirements of the GIPS standards. This includes using fair value for periods beginning on or after 1 January 2011 and using daily external cash flows beginning 1 January 2020. See the discussion of Provisions 22.A.22 and 22.A.23. MWRs that are calculated using inputs that do not meet all applicable requirements of the GIPS standards must not be presented in GIPS Asset Owner Reports.

Any MWRs that the asset owner chooses to include in the GIPS Asset Owner Report for a total fund or a total fund composite must be calculated using inputs that meet the applicable requirements of the GIPS standards, as described above.

Provision 21.A.24

If an ASSET OWNER competes for business, the ASSET OWNER MUST follow all sections of the GIPS Standards for Firms and all applicable REQUIREMENTS when competing for business.

Discussion

Most asset owners do not compete for business. An asset owner that does not compete for business and chooses to comply with the GIPS standards must comply with the GIPS Standards for Asset Owners and not the GIPS Standards for Firms when reporting performance to the oversight body. This means that the asset owner must calculate and present total fund and total fund composite returns that are net-of-fees. (A net-of-fees return reflects the deduction of transaction costs, all fees and expenses for externally managed pooled fund, investment management fees for externally managed segregated accounts, and investment management costs.) These net-of-fees returns must be included in a GIPS Asset Owner Report that is presented annually to the oversight body.

Some asset owners have the authority to compete for business by marketing to prospective clients and prospective investors, as traditional investment managers do. Asset owners that choose to comply with the GIPS standards when competing for business must follow the guidance and requirements of the GIPS Standards for Firms rather than the GIPS Standards for Asset Owners when competing for business.

It is also possible that an organization may act as both an asset owner, where investment authority and ownership are vested with the organization itself, as well as an asset manager, where it is competing for assets whose vesting lies with external clients. In such cases, the asset owner has two choices for how to define itself for the purpose of complying with the GIPS standards.

Option 1:

The asset owner bifurcates its assets into two entities: one defined as an asset owner and one defined as a firm. If an asset owner bifurcates its assets into two entities, it is not required to claim compliance with the GIPS standards for both entities.As an example, suppose that Asset Owner ABC, which acts as both an asset owner and an asset manager that competes for business and has been in existence for more than five years, has decided to bifurcate its assets into two separate entities for the purposes of complying with the GIPS standards: Asset Owner A, an asset owner, and Firm A, which competes for business.

-

- If Asset Owner A chooses to claim compliance, it must follow the GIPS Standards for Asset Owners. The total asset owner assets of Asset Owner A must include only those assets managed on behalf of the organization itself. It must not include the assets that are managed on behalf of clients and are included in Firm A. Asset Owner A must create a GIPS Asset Owner Report for its total funds, total fund composites, and any additional composites that it chooses to create and present in a GIPS Asset Owner Report, based on the assets in Asset Owner A. (An additional composite is a grouping of portfolios representing a particular strategy or asset class that the asset owner chooses to present in a GIPS Asset Owner Report.)